Are Hurricane Shutters Tax Deductible in Florida?

Introduction

Hurricane shutters are essential for safeguarding homes and businesses in Florida during the storm season. They provide protection against strong winds, flying debris, and heavy rainfall. However, one question that often arises is whether the cost of installing hurricane shutters can be tax-deductible in Florida. In this article, we will explore the tax implications of hurricane shutters in the Sunshine State, providing valuable information for homeowners and business owners alike.

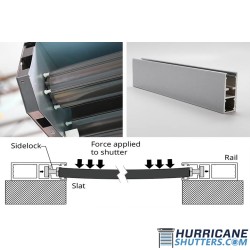

Understanding Hurricane Shutters

Before delving into the tax deductions, it's crucial to understand what hurricane shutters are and why they are so vital in Florida. Hurricane shutters are protective coverings typically made of metal, aluminum, or other sturdy materials that are installed over windows and doors. They are designed to withstand the impact of flying debris and help prevent windows from shattering during a hurricane or tropical storm. These shutters are a crucial part of hurricane preparedness in Florida, as they help protect property and, most importantly, lives.

The Tax Implications of Hurricane Shutters

Federal Tax Deductions

When it comes to federal taxes in the United States, hurricane shutters may not qualify for a direct tax deduction. The IRS typically allows deductions for expenses related to home improvements that increase the property's value or energy efficiency. While hurricane shutters do enhance the safety and security of a property, they may not necessarily increase its market value or energy efficiency.

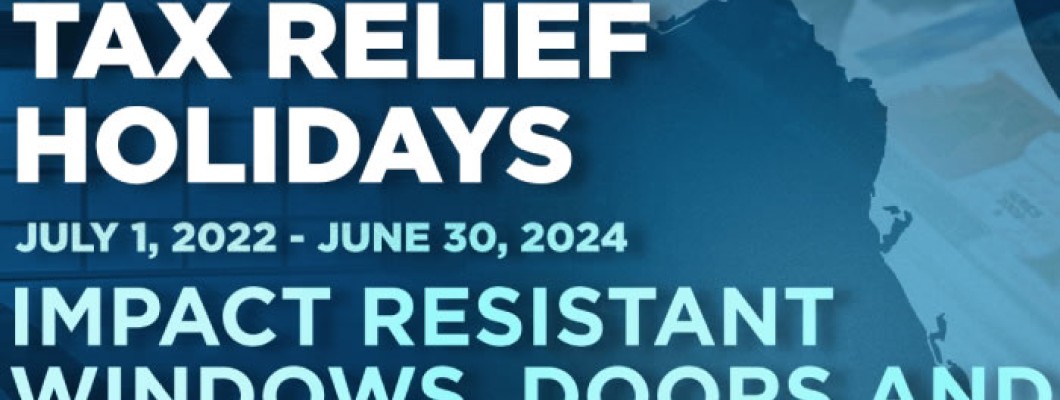

Florida State Tax Deductions

In Florida, there is no specific state tax deduction for hurricane shutters. The state primarily relies on sales tax for revenue, which means that homeowners and business owners will be subject to sales tax when purchasing hurricane shutters. However, there are some indirect ways in which you may be able to reduce your tax liability related to hurricane shutters.

Home Insurance Premiums

One way to potentially offset the cost of hurricane shutters is through your home insurance premiums. Many insurance companies in Florida offer discounts for homes equipped with hurricane mitigation measures, including hurricane shutters. By installing these protective coverings, you may be eligible for reduced insurance premiums, which can help you save money over time.

Property Appraisal

Another indirect benefit of installing hurricane shutters is the potential impact on your property's insurance appraisal. Insurance companies assess the risk associated with your property when determining premiums. By adding hurricane shutters, you demonstrate a commitment to protecting your property, which may result in a more favorable insurance appraisal, indirectly reducing your insurance costs.

Conclusion

In conclusion, hurricane shutters are not directly tax-deductible in Florida at the federal or state level. However, they can still provide financial benefits through reduced insurance premiums and a potentially more favorable property appraisal. It's essential to consult with a tax professional or insurance agent to fully understand the financial implications of installing hurricane shutters for your specific situation.

-Mount-Standard-Sizes-0-1-250x250w.jpg)

-(10ft.-Sections-5ft.-Poles-On-Center)-0-1-250x250w.jpg)

-0-1-250x250.jpg)

-0-1-250x250.png)